how to calculate tax on uber income

Your annual Tax Summary should be available around mid-July. Im not a tax expert or a professional CPA.

The Uber Lyft Driver S Ultimate Guide To Taxes Ageras

Youll use Schedule C to list your income and expenses and expenses write-offs.

. If your annual income is over 37000 then the. If your annual income is over 37000 then the tax rate is 325 and you can get 675 1-325455625. Yes most Uber drivers should be able to use the Section 199A deduction to deduct up to 20 of their business income.

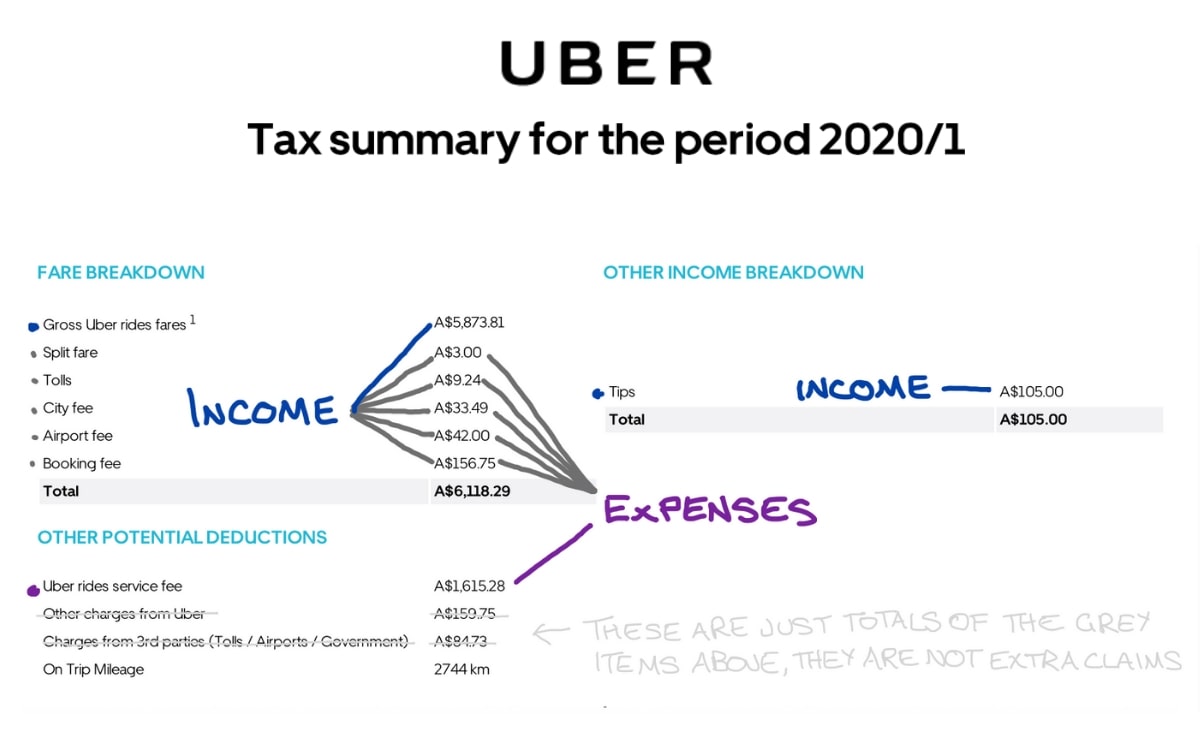

Estimate your business income your taxable profits. Saving For Your Uber Tax Bill How Is My Taxable Income From Uber Calculated. You can find tax information on your Uber profile well provide you with a monthly and annual Tax Summary.

This calculator will help you work out what money youll owe HMRC in taxes from driving for Uber. This marginal tax rate means that. Even if you earn.

Log in to your Uber account. Driver Net GST Liability c 659. The income amount is used in Schedule SE and this is used for calculating your self-employment taxes for Medicare and Social Security.

The ATOs Uber tax implications are straight-forward at a basic level. I think for most drivers who have other job should be over 37000. Were not going to break down every single.

Uber drivers are considered self-employed in Canada otherwise known as an independent contractor. Can I write off my car if. This calculator is created to help uber drivers to estimate their gst and tax consequenses.

Any money you make driving for Uber counts as income meaning you must declare it on your Tax return. Median Uber earnings per. From the dropdown menu select Partner Earnings.

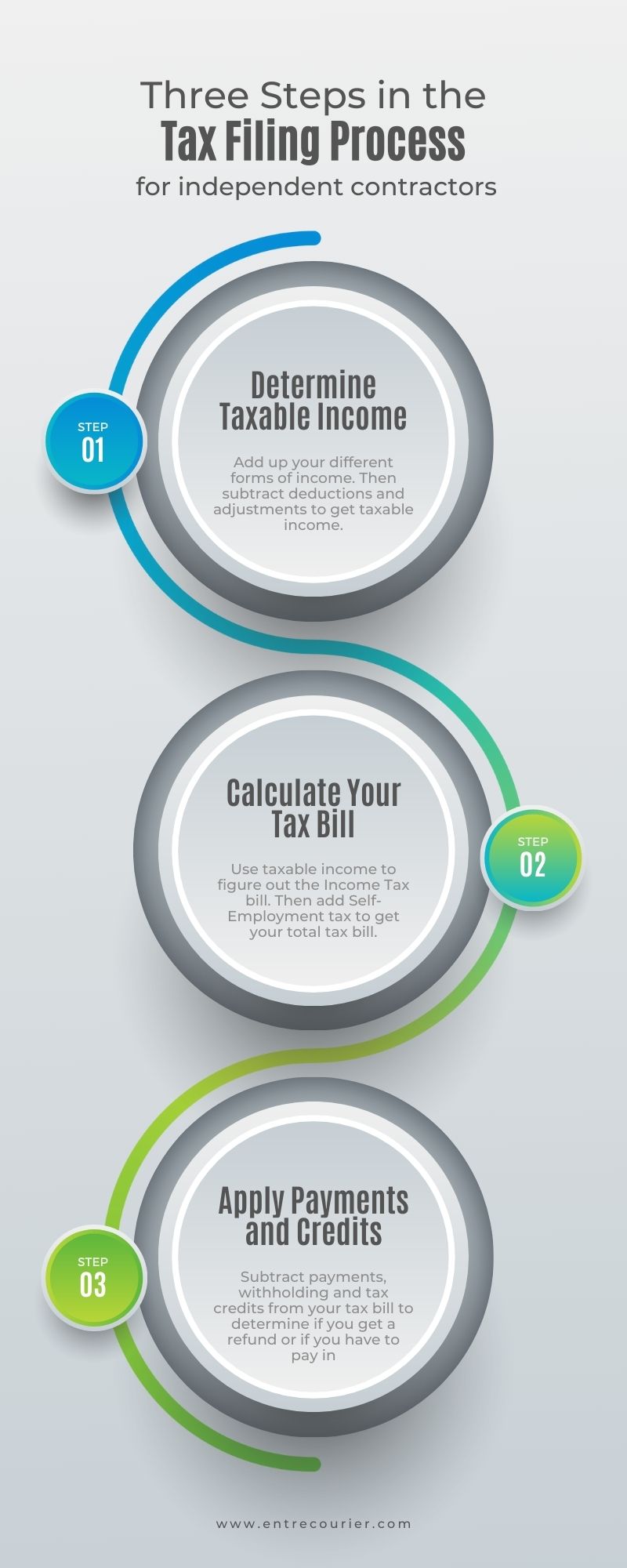

You start out by adding up your. The amount youll be required to pay tax on is calculated as follows. The result of this calculation will be your monthly take-home.

Gross Income Fares less. Deduct your rideshare expenses. 2 days agoThe final step is to take your salary divide it by 12 and then subtract all of your taxes and payroll deductions.

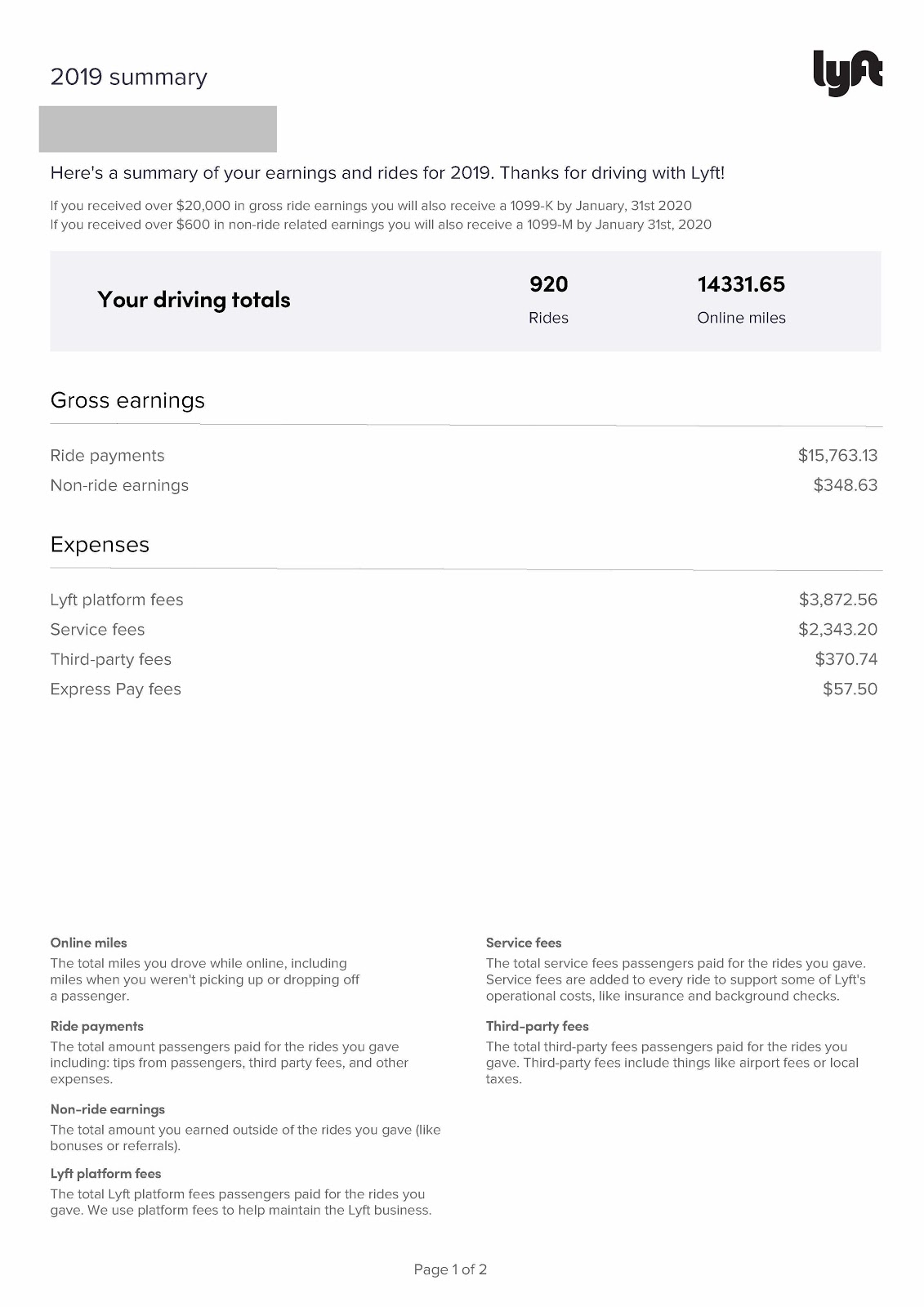

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. This is just a simple calculator to see an estimate of your taxes with standard deductions. Calculate your gross income from rideshare driving.

If you make 81900 a year living in the region of Texas USA you will be taxed 11005. As such Uber drivers must keep records of the money they receive. The self-employment tax is very easy to calculate.

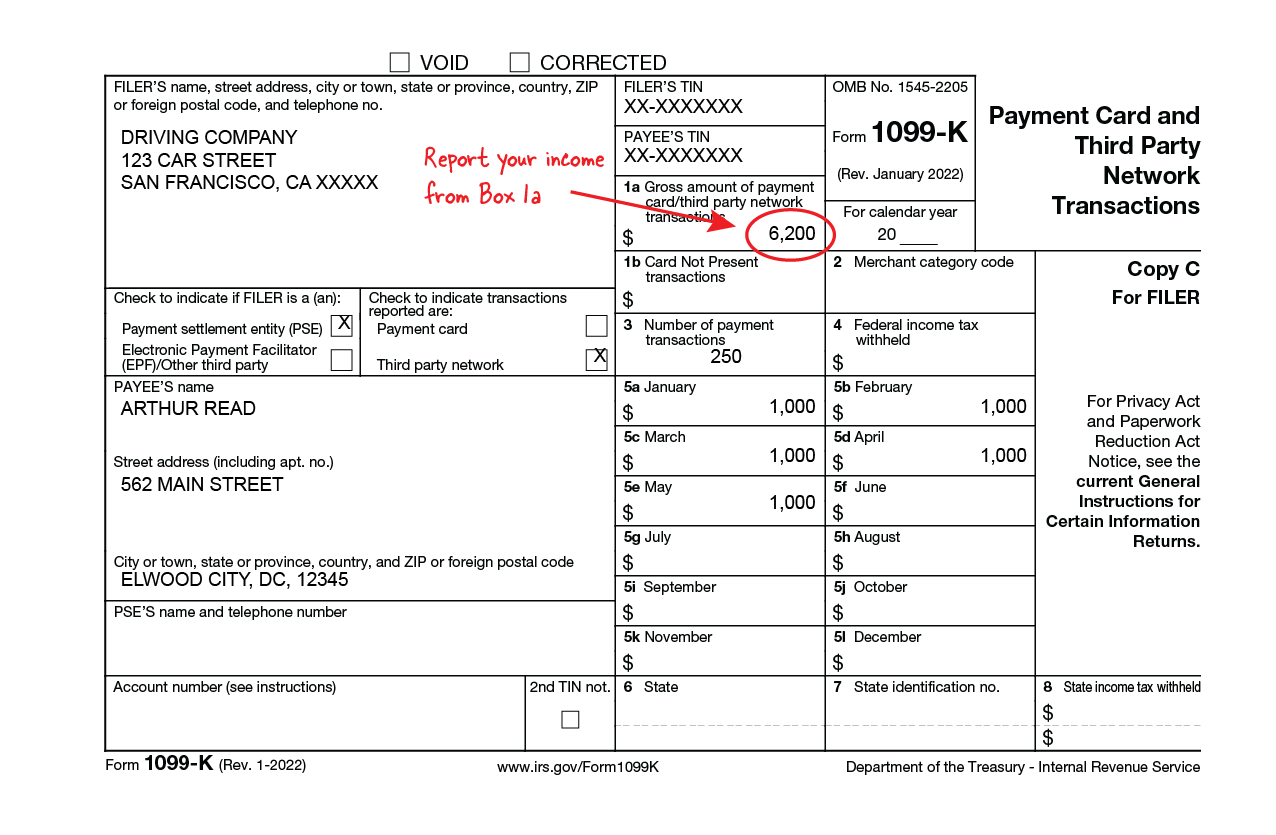

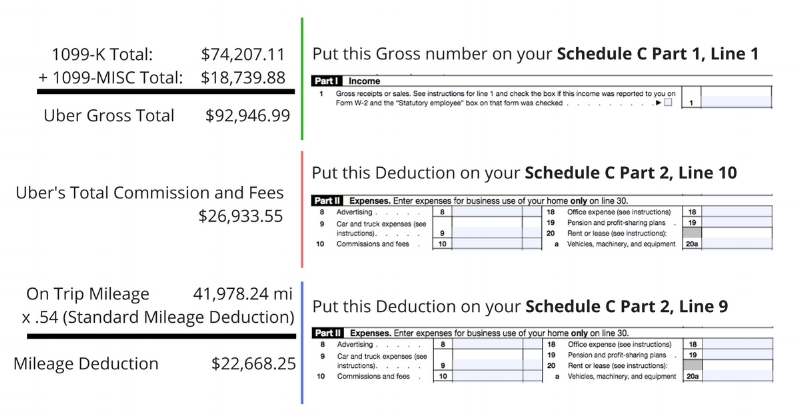

What the tax impact calculator is going to do is follow these six steps. Uber generally gives totals on your 1099-K and 1099. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Your average tax rate is 1344 and your marginal tax rate is 22. Once logged in navigate to the dashboard menu by clicking your nameicon in the top right. Can Uber drivers deduct 20 of their income.

Youll report income through the standard tax return Form 1040. You may receive two 1099 forms from Uber or Lyft but not always.

Uber Driver Tax Relief Instant Tax Solutions

Uber Tax Calculator Calculate Your Uber Estimate Hurdlr Uber Tax Uber Driver

Can You Claim Tax Back On The Nsw Government Levy Uber Drivers Forum

How To Report Income From Uber In A Canadian Tax Return Youtube

Ultimate Tax Guide For Uber Lyft Drivers Updated For 2022

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

Uber Tax Guide How To File Uber Taxes Report Income Mileiq

The Uber Lyft Driver S Ultimate Guide To Taxes Ageras

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

How Do Uber And Lyft Drivers Count Income Get It Back

How To File Your Uber Driver Tax With Or Without 1099

How Uber S Tax Calculation May Have Cost Drivers Hundreds Of Millions The New York Times

How Do Uber And Lyft Drivers Count Income Get It Back

Uber Eats Tax Calculator How Much Extra Will I Pay From Uber Eats Income

Free Uber Tax Accounting Software Instabooks Us

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Tax Tips For Rideshare Drivers Tax Guide For Lyft Uber Drivers